Explore all blogs

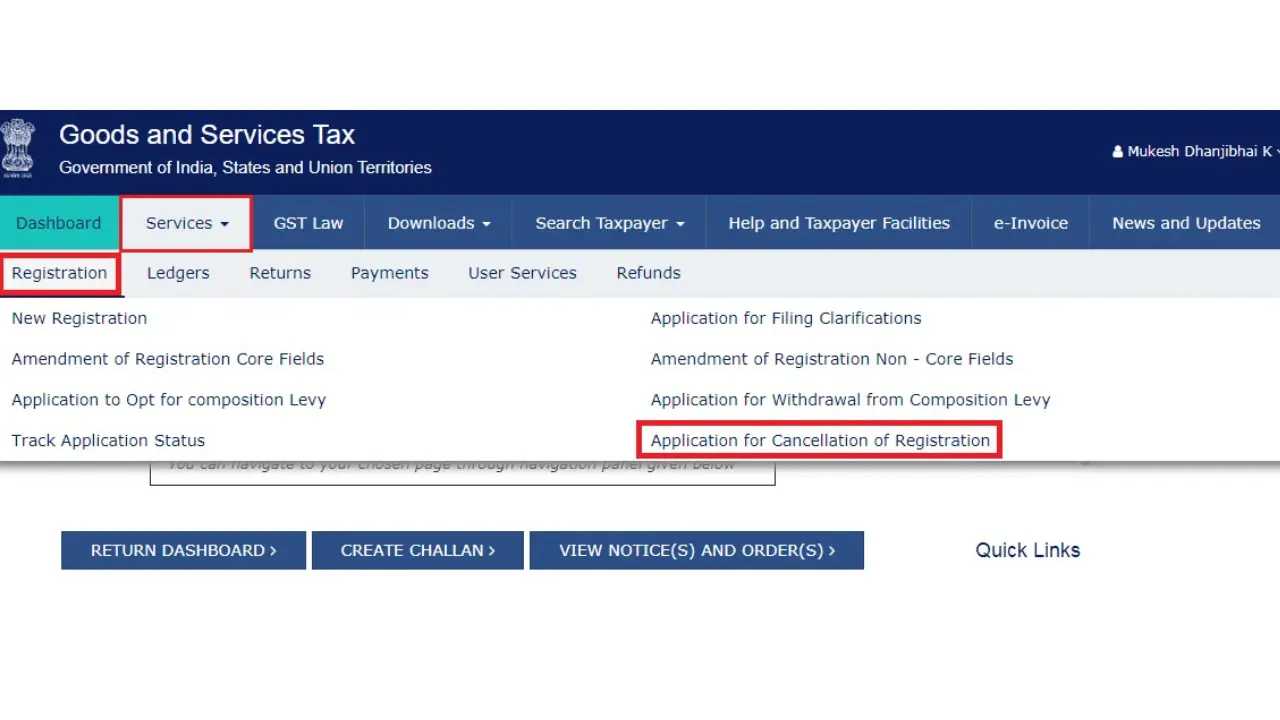

How to Cancel GST Registration: Online Process, Form REG-16 & Eligibility

Learning how to cancel GST registration is important for business owners who have stopped operations, restructured their company, or whose turnover has fallen below the GST limit. Once cancellation is completed, the business is no longer required to file GST returns or charge GST to custo

Written by Vivek Mishra

Published on

GST Registration Process: Meaning, Types, Charges and Documents in 2025

Goods and Services Tax (GST) is a unified indirect tax in India, implemented on July 1, 2017, replacing multiple taxes like VAT, service tax, and excise duty. It applies to the supply of goods and services and includes CGST, SGST, and IGST, depending on the nature of the transaction. GST

Written by Simon Ghosh

Published on

How to Register a Company in India: Legal Requirements & Compliance Checklist (2025)

A company is a legal entity distinct from its owners, created to conduct business activities with a structured organisational framework. Unlike individual proprietorships, a company possesses its own legal identity, capable of owning property, entering into contracts, and incurring liabil

Written by Vivek Mishra

Published on

GST on Flats Below 45 Lakhs: Everything You Need to Know

The Goods and Services Tax (GST) has significantly impacted the real estate sector in India, particularly for affordable housing. For GST on flats below 45 lakhs, the government has introduced special GST provisions to make homeownership more accessible. These rules aim to stimulate the a

Written by Simon Ghosh

Published on

GST Laws - All You Need to Know

By integrating a technological layer into the taxation system, GST makes it easier for taxpayers to use taxpayer services. Knowing the right facts about GST will make it easy for you to perform GST registration, returns and payments. Here’s all that you need to know-

Written by Prakhar Sushant

Published on

Offences and Penalties Under GST

The GST regime prescribes strict penalty provisions to deal with tax offenders who indulge in corrupt GST practices. If you are a taxpayer registered to GST, you must be aware of the offences and penalties under GST that can be imposed upon you under different scenarios.

Written by Kruthi

Published on