Explore all blogs

How to Convert Agricultural Land to Residential Land in India? Land-Use Conversion 101

If you are not one of the people who prefer to move into readymade apartments in societies, but rather build your vision on a plot of land you can call your home, you must first confirm that the land is clear from any legal issues. In a vast agricultural country like India for example, yo

Written by Simon Ghosh

Published on

FSI in Mumbai 2025: Calculate FSI in Mumbai Municipal Corporation

Floor Space Index or FSI in Mumbai refers to the ratio between the complete built-up area of a plot and the available plot area. The guidelines for FSI for residential building in Mumbai are determined by the government of the region and follows the National Building Code for the ent

Written by Vivek Mishra

Published on

Guideline Value in Chennai: Meaning, Importance and Steps to Check

Property guideline value in Chennai is a must if you are looking to purchase a house or land in Chennai. The guideline value in Chennai can be easily accessed via the online portal of the registration department of Tamil Nadu. It is important to check the guideline value,

Written by Vivek Mishra

Published on

Guidance Value in Bangalore 2025

The state government of Karnataka has recently decided to slash the guidance value of property in Bangalore by 10% starting from Jan 1, 2023. This comes as a major relief for the real estate sector in the city which continues to push back after the pandemic and lockdown’s effects. But do

Written by Kruthi

Published on

Stay Order in India: What You Need to Know

Curious about what a stay order is in India? Picture this: Three brothers file a case for property partition. Later, a stranger claims ownership of the same property. Now, there are two conflicting cases involving the same property and individuals. This is where a stay order steps in. A s

Written by Simon Ghosh

Published on

Circle Rates Faridabad 2025: A Guide for First-Time Homebuyers

Looking to buy property in Faridabad? In Faridabad, circle rates are critical in calculating stamp duty and registration fees for property transactions. Established by the Haryana Government, these rates vary across different areas and property types. These rates impact stakeholders, incl

Written by Priyanka Saha

Published on

Jantri Rates in Gujarat: Property Valuation Guide in 2025

If you plan to rent, buy, or sell property in Gujarat, understanding the Jantri Rates Gujarat is vital. These rates, also called "Stamp Duty Ready Reckoner Rates," are government-assigned values that help determine property market values for stamp duty and registration fees. Published ann

Written by Suju

Published on

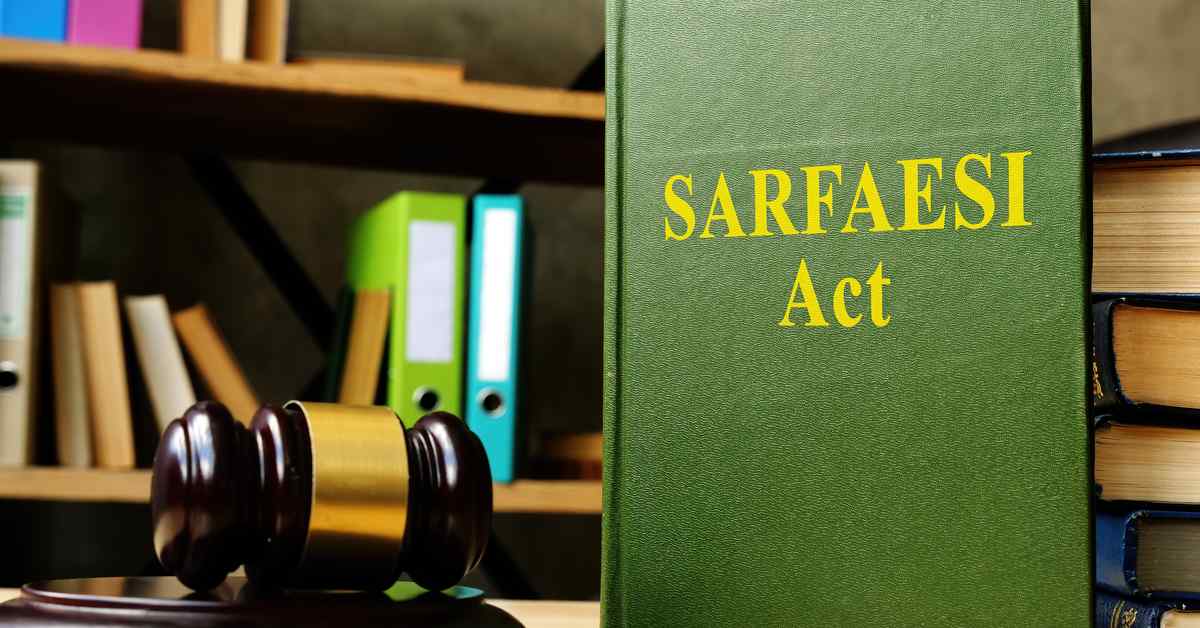

SARFAESI Act of 2002: Guide to Asset Recovery and Financial Security in 2025

The full form of the SARFAESI Act is the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest Act. SARFAESI was passed in 2002. This act manages how financial assets are turned into securities and rebuilt. It also ensures security interests are enforc

Written by Vivek Mishra

Published on