Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Tambaram Property Tax Tamil Nadu 2025: Online and Offline Payment, Tax Rebates and Calculations

Table of Contents

Tambaram Property Tax 2025 is a tax collected by the Tambaram City Municipal Corporation (TCMC) from property owners. The tax is collected to maintain public services like roads, sewage, government, schools, and hospitals. Property Tax Tambaram is a mandatory tax that is collected for residential, industrial, and commercial properties.

Tambaram Property Tax online payment can be made through the official website. It is a smooth process because it can be made from home. Apart from online, there are offline payment options through designated municipal offices and banks. The tax amount is calculated based on property type, location, and usage. Property owners should always check the official website for updates and pay the tax on time to avoid penalties. The blog below will guide you through the step-by-step process of property tax in Tambaram.

Tambaram Municipality Property Tax Quick Info 2025

| Information | Details |

| Official Website Link | https://tnurbanepay.tn.gov.in/ |

| Tax Payment due date | March 31, 2025, to September 30, 2025 |

| Rebate | 5% rebate |

| Penalty for late payment | 1% per month of due amount |

| Method for Tax Calculation | Annual Rental Value (ARV) |

| Tax Rates | The tax rate is based on the location, property type, and usage. |

| Payment method | Payment methods include online payment via TCMC’s official website, credit/debit cards, net banking, UPI, and offline payment via designated banks and municipal offices. |

| Properties for tax payments | Residential, Industrial and commercial & vacant lands |

| How to check Status | Visit the TCMC Property Tax website and check using the Assessment number. |

| Contact Details | Address: 28, Muthurenga Mudali Street, West Tambaram, Chennai – 600 045 Contact Number: 044-22266206, Toll-free number:18004254355Email: commr.tambaram@tn.gov.in |

Are you a homeowner in Tambaram looking to unravel the complexities of property taxation? Like a compass guiding through uncharted waters, understanding Tambaram property tax is crucial for smooth sailing in the realm of real estate ownership. In this comprehensive guide, we will delve into the intricacies of Tambaram property tax, providing invaluable insights and strategies for homeowners.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

What is Tambaram Property Tax?

Tambaram property tax is a levy imposed by the Tambaram City Municipal Corporation (TCMC) on properties situated within the city limits of Tambaram, Tamil Nadu, India. This tax serves as a vital revenue stream for the corporation, supporting a range of civic services and infrastructure development projects across the city. Tambaram property tax for residential property is ₹0.60 - ₹2.40.

How Can I Pay Tambaram Property Tax Online in 2025?

The Tambaram property tax is paid online in the below steps:

- Visit the website: https://tnurbanepay.tn.gov.in/

- Click on the quick payment option.

- Then, search for the property tax option.

- Enter your assessment number to view the payment details.

- Proceed to make the payment online using upi options and confirm the payment.

How Can I Download the Tambaram Property Tax Bill or Receipt for 2025?

Here are the simple steps to download the Tambaram property tax bill:

- Visit the Tnurban E-pay portal: https://tnurbanepay.tn.gov.in/.

- Look for the section labeled "View Property Tax Bill" or "Download Receipt".

- Find the option to search for your property using a unique identification number or address.

- Enter the required details to locate your property.

- Download a PDF copy of the receipt.

Benefits of Online Tambaram Property Tax Payment

Here are several advantages of using the online system to pay your Tambaram property tax:

Convenience:

- Access Anytime, Anywhere: You can make your property tax payments from your home or office at any time, day or night, without the need to visit a TCMC office during business hours.

- Speedy Transactions: The online payment process is faster than traditional methods like queuing at a physical office.

Efficiency:

- Less Paperwork: The entire process is conducted digitally, eliminating the need to print forms or send mail, thus supporting environmental sustainability.

- Simple Record Keeping: Digital payment receipts are easily accessible for your records, allowing you to download and store them electronically for future use.

Security:

- Protected Transactions: The online payment systems employed by TCMC use secure protocols to ensure the safety of your financial information during transactions.

Tambaram Property Tax Offline Payment 2025

You can pay your Tambaram Property Tax for 2025 offline using several methods:

In-Person at TCMC Offices:

- Visit a designated Tambaram City Municipal Corporation (TCMC) office. These offices likely have timings, so check the TCMC website (https://www.tnurbantree.tn.gov.in/tambaram/) for office locations, timings, and any specific instructions for offline payments.

- Carry the property tax bill you might have received (though it might not be mandatory) and be prepared to make the payment with cash, cheque, or demand draft.

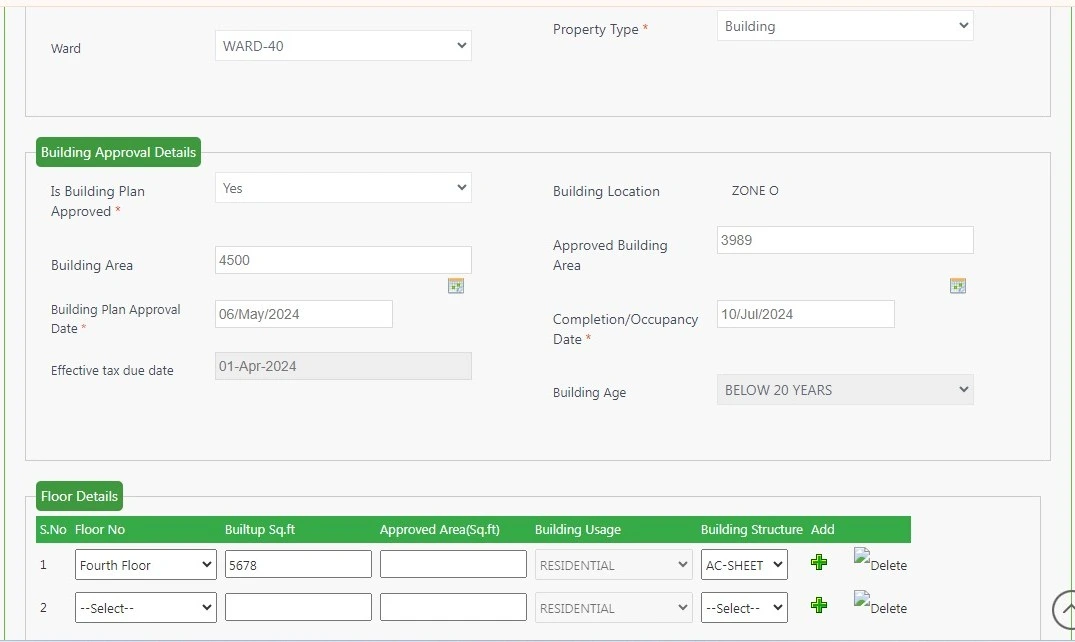

Tambaram Property Tax Calculator 2025

The Tnurban E-pay portal (https://tnurbanepay.tn.gov.in/) may feature a "Property Tax Calculator" section (the exact name could differ) applicable to various municipalities. Tambaram property tax is calculated based on factors like property type, size, location, and age. An online calculator might not be able to account for all the nuances involved in the assessment process.

Visit the website and enter your property details to check the calculation. Your report will be ready in minutes.

Tambaram Property Tax Rebate 2025

In Tambaram, all property tax owners who pay their taxes on time or before April 30, 2025, are eligible for a 5% rebate as part of the early bird scheme. This initiative by the TCMC encourages taxpayers to pay on time and save money. Check the official website and clear all the dues before April 30 to get the discount.

Tambaram Property Tax Rate 2025

The property tax rate in Tambaram depends on several factors. Firstly, commercial properties generally incur a higher tax rate than residential properties. The city is divided into zones, each with a designated "Basic Street Rate" (BSR) used in tax calculations. Consequently, higher-value areas might have a higher BSR. Moreover, the size of your land and building footprint will be considered in the calculation. Furthermore, some municipalities consider factors such as the age of the property or amenities offered, like parking, when determining the tax rate.

- Residential Property: ₹0.60 - ₹2.40

- Non Residential: ₹4 - ₹12

Tambaram Property Tax Transfer Online 2025

Here are the procedure for Tambaram Property Tax Transfer Online 2025:

- Complete the online application form for property tax transfer.

- Attach all necessary supporting documents as specified.

- Receive alerts via SMS or email confirming receipt of your application and its status updates.

- Submit your completed application online.

- The relevant authorities will review your application and the submitted documents.

Tambaram Property Tax App 2025

The Tnurban E-pay app is a mobile application launched by the Government of Tamil Nadu that allows citizens of various municipalities to pay for their municipal services through their smartphones. Here’s a breakdown of the app’s features and functionalities:

Key Features:

Municipal Service Payments: You can use the app to pay for a variety of municipal services, including:

- Property Tax

- Water Supply Charges

- Underground Drainage Charges

- Professional Tax

- Non-Tax Payments (may vary by municipality)

- Building Plan Tax (in some municipalities)

- Trade Renewal & License Fees (in some municipalities)

- Water & UGD Deposit Tax (in some municipalities)

Payment Methods: The app offers various payment methods for your convenience, including:

- Debit Cards

- Credit Cards

- Net Banking

Tambaram Property Tax Helpline Number

For inquiries related to property tax in 2025, the Tambaram City Municipal Corporation (TCMC) provides a helpline number. You can reach them at 18004254355 for assistance.

Tambaram Property Tax Last Due Date in 2025

Typically, property tax payments in Tamil Nadu are due between September 30th and March 31st of the following financial year.

How to Pay Tambaram Property Tax Bill Using NoBroker Pay

NoBroker Pay provides a secure and transparent way to pay your bills. Follow these simple steps to complete your payment:

- Download the NoBroker Pay app.

- If you are a first-time user, fill in your bank details and set up your account.

- Select the type of property tax from the available options.

- Input your property tax details.

- Review the bill information.

- Choose your preferred mode of payment.

- Confirm the property tax payment.

- Finally, download the receipt for your records.

Legal Services Offered by NoBroker

NoBroker offers a range of legal services specifically tailored to Tambaram Property Tax transactions. Here's an overview of our services:

- Document Scrutiny: Our legal team meticulously examines critical documents, including title deeds, property documents, and sale agreements. This scrutiny helps uncover any potential issues before finalising property deals.

- Protection Measures: We safeguard you from potential fraud by conducting thorough checks for existing property legal disputes and verifying ownership details.

- Service Packages: NoBroker presents various legal service packages designed to meet your specific needs:

- Buyer Assistance: Receive guidance and support throughout the buying process.

- Registration Assistance: Let us handle the property registration process to save you time and hassle.

- On-Demand Services: Tailored services include property title checks, guidance on market value, assistance with missing documents, and verification of occupancy certificates, catering to those who require specific assistance.

- NoBroker Pay: Utilising NoBroker Pay ensures a secure and convenient method for making your Tambaram Property Tax payments. Furthermore, you can conveniently track all your payments within a single platform.

How to Book NoBroker Legal Services

Here's a step-by-step guide for booking NoBroker Legal Services seamlessly and securely:

- Access NoBroker Platform: Download the NoBroker app on your smartphone or visit the NoBroker website.

- Navigate to the Legal Services Section: Locate and click on the NoBroker Legal Services section within the app or website interface.

- Browse Services Offered: Explore the range of services available, including drafting agreements, property verification, and legal consultations.

- Select Desired Service: Choose the specific service you require, then fill in your details and complete the provided form.

- Consultation and Assistance: A NoBroker expert will reach out to you via phone or chat to gather further information. Alternatively, you can book a free consultation call for any inquiries.

- Online Rental Agreements: Additionally, on the legal services page, you'll find online rental agreements that you can purchase and customise directly on the NoBroker website.

Why Choose NoBroker Legal Services

Here are several compelling reasons why you should consider NoBroker legal services:

- Convenience: NoBroker provides unparalleled convenience by enabling you to handle legal tasks from the comfort of your home. Consequently, there's no need for time-consuming visits to a lawyer's office.

- Affordability: Our legal services are remarkably affordable, offering cost-effective solutions that stand out in comparison to traditional lawyers' fees.

- Experienced Lawyers: We collaborate with seasoned lawyers boasting a minimum of 15 years of experience and holding qualifications from the Bar Council. With NoBroker, you gain access to top-tier legal expertise.

- Streamlined Process: NoBroker streamlines the legal process with pre-defined service packages, simplifying decision-making. Furthermore, we manage all communication with the lawyer on your behalf, saving you time and effort.

- Technology-Driven: Leveraging advanced technology, we enhance efficiency and service delivery. From document management to communication, our technology-driven approach ensures a seamless experience for our clients.

Explore Property Tax Payment Options City-Wise in India

NoBroker: Enhancing Efficiency in Property Transaction Legal Processes

Tambaram property tax funds civic services and infrastructure development projects within the city. By understanding the factors influencing tax rates and utilising online payment options, homeowners can effectively manage their tax obligations and contribute to the growth of Tambaram's community.

For dependable assistance in managing Tambaram property tax and receiving expert legal guidance, schedule a complimentary consultation with NoBroker's proficient professionals. Utilise NoBroker Pay for a secure and seamless method to settle your Tambaram property tax payments, all conveniently tracked in one location. Additionally, streamline the stamp duty process effortlessly through our platform. Download the app now for effortless property tax management!

Frequently Asked Questions

Ans: Yes, you can conveniently pay your Tambaram Corporation property tax online through the Tnurban E-pay portal (https://tnurbanepay.tn.gov.in/IntegratedPaymentNew1.aspx). This portal allows you to make online payments for various municipalities in Tamil Nadu, including Tambaram.

Ans: To check the status of Tambaram Municipal Corporation Property Tax, visit the official website of TCMC. Under the Property Tax section, click on ‘Assessment Search’. Once the tax is paid, you can check the property tax status online.

Ans: There are several advantages to paying your Tambaram house tax (property tax) online. You can avoid queues and save time compared to visiting a physical office. The online payment portals utilise secure protocols to safeguard your financial information.

Ans: The exact due date for Tambaram property tax payments is March 31, 2025, to September 30, 2025

Ans: Currently, there doesn't seem to be an online system for updating Tambaram property tax records after a transfer. You'll likely need to contact a lawyer or real estate professional to handle the legal aspects of the transfer and then approach TCMC with the necessary documentation to update the records.

Recommended Reading

Nagpur Property Tax: Online Bill Payment, Receipt Download and Tax Calculator in 2025

March 28, 2025

60253+ views

GHMC Property Tax Hyderabad: Payment, Rebates, Tax Calculations and Rates for 2025

March 25, 2025

48264+ views

MCGM Property Tax 2025 - How to Pay BMC Mumbai Property Tax Online

January 31, 2025

43114+ views

BDA Property Tax Bangalore: Online Payment, Receipt Download, Rebates, and Rates for 2025

March 25, 2025

38986+ views

How to Pay Your Kulgaon Badlapur Property Tax Online: Tax Rebates, Rates and Calculations for 2025

March 26, 2025

33278+ views

Loved what you read? Share it with others!

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1115449+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

193468+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

133105+ views

Rectification Deed Format and Process in India 2025

June 1, 2025

128277+ views

Recent blogs in

How To Register a Rent Agreement Online In Gujarat: Process, Documents and Fees in 2026

January 19, 2026 by Ananth

What is Registered Lease Agreement: Meaning, Legal Validity, Benefits and Online Registration

January 19, 2026 by Krishnanunni H M

What Is a Room Rental Agreement: Meaning, Purpose and Importance in 2026

January 12, 2026 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!