Tax Residency Certificate (TRC) is a crucial document for NRIs or anyone earning income from foreign sources. In this blog, we will discuss everything about the TRC, from what is TRC to its applicability to how to obtain it, and its validity. By reading this blog, you will learn about the importance of the TRC, the documents required to apply for it, and how NoBroker can help you get it hassle-free. So, let’s dive in!

What is a Tax Residency Certificate?

Confused what is a TRC Certificate? A Tax Residency Certificate (TRC) is a document issued by a country’s tax authorities to confirm an individual’s or company’s tax residency status. It serves as proof that the recipient is a tax resident of a particular country and is eligible for certain tax benefits under the Double Taxation Avoidance Agreement (DTAA) between the two countries. TRCs are particularly important for non-resident Indians (NRIs) and business owners who have dealings in multiple countries.

Recommended Reading

Types of Resident in Income Tax

Understanding the classification of residents under income tax laws is crucial for determining one's tax obligations and privileges. Different countries have various criteria for defining tax residency, often based on the duration of stay or the centre of economic interest. Here are the primary types of residency statuses commonly recognised in income tax regulations:

- Ordinary Resident: This category includes individuals who are residents in a country for tax purposes, typically determined by their physical presence over a certain period within the tax year. Ordinary residents are usually taxed on their worldwide income.

- Statutory Resident: Often defined by specific criteria such as spending more than a predetermined number of days in the country during the tax year. Statutory residents are required to pay taxes on all income earned within and sometimes outside of the country, depending on national laws.

- Non-Resident: Individuals who do not meet the residency requirements are considered non-residents. They are generally taxed only on the income earned from sources within the country.

- Deemed Resident: This status applies to individuals who, for tax purposes, are treated as residents based on factors other than their physical presence. This could include the location of their permanent home, their family, or their economic interests.

- Part-Year Resident: Individuals who change their residency status during the tax year may be classified as part-year residents. They typically owe taxes proportionate to the amount of time they spent as residents.

Eligibility Criteria For Obtaining TRC

To be eligible for a TRC, an individual or company must be a tax resident of the issuing country, as per the tax laws of that country. Additionally, the applicant must have a permanent establishment or fixed place of business in the foreign country, or they must be a resident of that country for a certificate of residence for tax purposes.

Benefits of a Tax Residency Certificate

A Tax Residency Certificate (TRC) is a vital document for individuals and businesses that need to prove their tax status in a specific country. This certificate is particularly important for those who have cross-border economic activities, as it helps establish their tax residence to claim benefits under international tax treaties. Here’s how obtaining a TRC can be beneficial:

- Avoidance of Double Taxation: TRC serves as a key tool to prevent double taxation on the same income in two different countries, thus reducing your overall tax burden.

- Eligibility for Tax Treaties: It allows taxpayers to take advantage of reductions in tax rates and exemptions offered under tax treaties between countries.

- Streamlined Tax Reporting: Having a TRC simplifies the process of tax reporting by clearly establishing which country’s tax laws apply to the taxpayer’s income.

- Enhanced Credibility with Tax Authorities: Possessing a TRC adds a layer of credibility to your financial affairs, showing tax authorities that your tax status is clear and validated.

- Legal Protection: The certificate provides a legal basis for your tax residence, protecting you from potential legal issues concerning your residency status.

- Improved Financial Planning: By clarifying your tax obligations, a TRC helps in better financial and business planning.

Significance of TRC for NRIs and Business Owners

TRCs are significant for NRIs and business owners as they can help them avoid double taxation on their income earned in a foreign country. With a TRC, they can avail of tax benefits under the DTAA between the two countries, including reduced rates of tax withholding on their income. This can help them save money and avoid the hassle of dealing with complex tax laws in multiple countries.

TRC Validity And Renewal Process

TRCs are typically valid for one financial year, and they need to be renewed every year to continue availing of the tax benefits under the DTAA. The renewal process is similar to the initial application process, and the applicant needs to submit the required documents and information to the tax authorities in the issuing country.

How to Apply for a Tax Residency Certificate

Tax residency certificates (TRCs) are important documents that establish an individual's tax residency status in a foreign country. For NRIs and business owners, obtaining a TRC can help them avoid double taxation and simplify their tax filing process. In this section, we will provide a step-by-step guide on how to apply for a TRC in India, along with some tips to ensure a smooth application process.

How to Obtain a Tax Residency Certificate for NRIs?

Applying for a TRC in India involves several steps that can be completed either online or offline. Here is a step-by-step guide to help you through the process:

- Determine your eligibility: Before applying for a TRC, you must ensure that you meet the eligibility criteria outlined by the Indian government.

- Gather necessary documents: You will need to gather several documents, including proof of identity, address, and tax residency.

- Fill out the TRC application form: The application form is available online and must be filled out with accurate information.

- Submit the application: Once the application is complete, it must be submitted along with the required documents.

- Track the status of your application: You can track the status of your application online and will receive an email notification when the TRC is ready for collection.

Documents Required For TRC Application

When applying for a TRC in India, you will need to provide the following documents:

- Proof of identity: Passport, PAN card, Aadhaar card, or other government-issued ID.

- Proof of address: Utility bill, bank statement, or rental agreement.

- Tax residency proof: Tax return filed in India or the foreign country, or a certificate of residency issued by the foreign country.

- Other documents: Application form, photographs, and any other documents required by the Indian government.

Tax Residency Certificate Format

The format of a Tax Residency Certificate (TRC) can vary depending on the country issuing it, but most certificates contain key elements that are internationally recognised to satisfy tax authorities and treaty partners. Here is a general outline of what a typical TRC might include:

- Title: The document should be clearly labeled as a Tax Residency Certificate at the top.

- Issuing Authority: The name and contact details of the tax authority issuing the certificate.

- Certificate Number: A unique identifier for the certificate.

- Date of Issue: The date on which the certificate was issued.

- Validity Period: The time period for which the certificate is valid, typically for one fiscal year.

- Taxpayer Details:

- Name: The full name of the individual or entity.

- Address: The current address as per tax records.

- Tax Identification Number (TIN): The tax number assigned to the individual or entity.

- Date of Birth/Incorporation: For individuals, their date of birth; for entities, the date of incorporation.

- Residency Status: A statement confirming that the individual or entity is a resident for tax purposes in the issuing country for the specified tax year.

- Purpose of Certification: The reason for which the TRC is being issued, typically to claim benefits under a tax treaty.

- Signature: The certificate must be signed and stamped by an authorised official of the issuing tax authority.

- Additional Notes: Any additional remarks or legal references that support the residency claim.

Common Mistakes to Avoid During TRC Application

While applying for a TRC, it's important to avoid common mistakes that can delay the process or result in rejection. Here are some mistakes to avoid:

- Inaccurate information on the application form.

- Submitting incomplete or missing documents.

- Failing to meet eligibility criteria.

- Applying for a TRC when it's not required.

- Choosing the wrong TRC category.

Online vs Offline TRC Application Process

In India, you can apply for a TRC either online or offline. The online process is faster and more convenient but requires you to have a digital signature. The offline process, on the other hand, is more time-consuming but allows you to submit physical copies of documents. The table below summarises the pros and cons of each method:

| Method | Pros | Cons |

| Online | Faster and more convenient | Requires digital signature |

| Offline | Allows physical copies of documents to be submitted | More time-consuming |

By following these guidelines and ensuring that you meet the eligibility criteria and have all the necessary documents, you can easily apply for a TRC in India and enjoy the benefits of tax residency status.

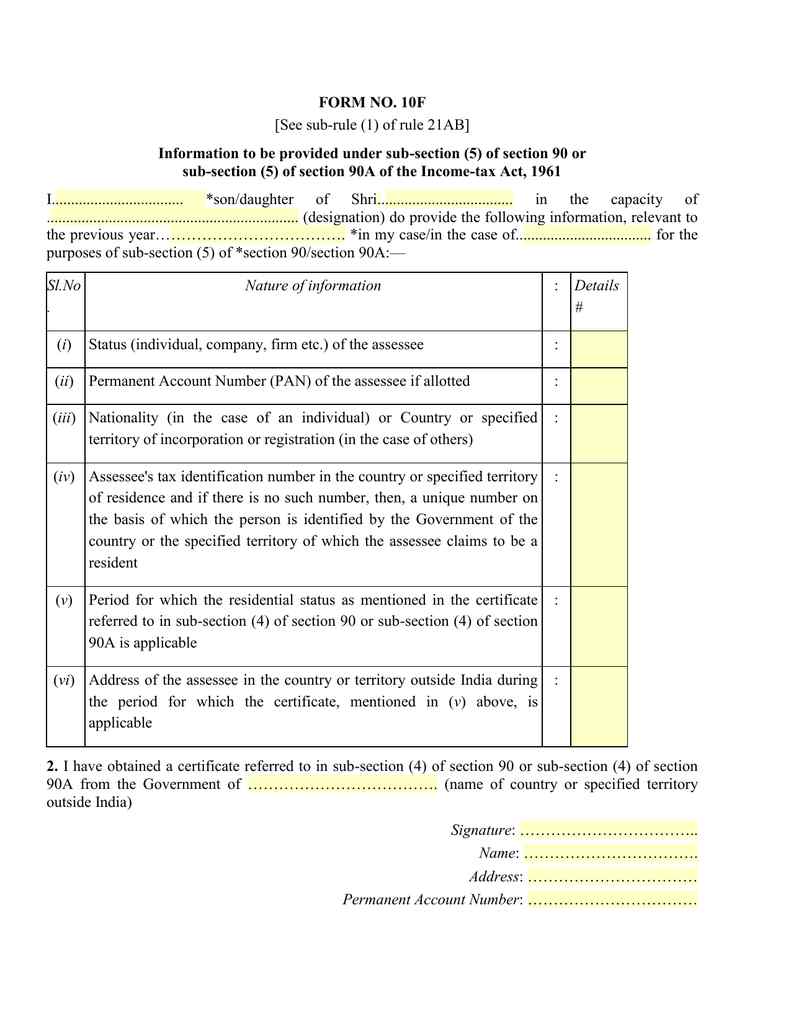

Everything NRIs need to know about Form 10F for Income Tax

Understanding Form 10F and Its Significance for Non-Resident Britons

Form 10F plays a pivotal role in the financial lives of non-resident Britons (NRBs) seeking to benefit from the Double Taxation Avoidance Agreements (DTAA) between the United Kingdom and India. This crucial document verifies the tax residency status of NRBs in the UK, enabling them to assert tax relief on income earned in India.

Neglecting to submit Form 10F can result in NRBs being subjected to higher tax rates. To qualify for Form 10F, NRBs must adhere to specific criteria, including residing in a country that has a DTAA with India, lacking a permanent establishment in India, maintaining a tax liability in India below the designated threshold, and providing evidence of their tax residency status abroad.

Navigating the Form 10F process involves obtaining a Tax Residency Certificate (TRC) from the UK, accurately completing the form, and attaching essential documents before submitting it to the Income Tax Department. Avoidable errors during this process encompass inaccuracies on the form, omission of the TRC and vital supporting documents, missing the filing deadline, and failing to seek advice from tax experts regarding the repercussions of Form 10F submission.

Read: TDS on Sale of Property by NRI: Guide from Sale to Taxation

How to obtain a Tax Residency Certificate in Bangalore?

Where to apply for a TRC certificate in Bangalore

NRIs residing in Bangalore can apply for a TRC certificate at the Income Tax Office located in their jurisdiction. The jurisdictional office can be identified based on the residential address of the applicant.

Process For Obtaining TRC Certificate In Bangalore

The process for obtaining a TRC certificate in Bangalore involves the following steps:

- Obtain the application form from the jurisdictional Income Tax Office or download it from the Income Tax Department website.

- Fill in the relevant details in the application form.

- Attach the required documents such as a copy of the passport and visa.

- Submit the application form along with the fee to the jurisdictional Income Tax Office.

- The TRC certificate will be issued within a few weeks.

Important Documents Required For TRC Application in Bangalore

The following documents are required for obtaining a TRC certificate in Bangalore:

- Application form

- Copy of the passport

- Copy of the visa

- Proof of tax residency in the foreign country

- Fee payment receipt

Common Issues Faced By Applicants In Bangalore

While applying for a TRC certificate in Bangalore, applicants may face various issues such as:

- Lack of proper documentation: Applicants must ensure that they have all the required documents before applying for a TRC certificate in Bangalore. Lack of proper documentation can result in the rejection of the application.

- Delay in processing: The processing time for a TRC certificate can take up to several weeks or even months. Applicants should plan accordingly and apply well in advance to avoid any inconvenience.

- Technical issues: Applicants may face technical issues while applying online for a TRC certificate in Bangalore. It is advisable to seek help from a professional or the concerned authorities in such cases.

- Difficulty in scheduling appointments: Applicants may find it difficult to schedule an appointment with the concerned authorities in Bangalore for submitting their TRC application. They should be prepared to follow up regularly to secure an appointment.

- Language barrier: Language can be a barrier for non-native speakers while communicating with the authorities. It is advisable to have a translator or a person proficient in the local language to assist during the application process.

Benefits of Obtaining a Tax Residency Certificate

If you are an NRI or a business owner, obtaining a Tax Residency Certificate (TRC) can bring several benefits. Here are some key benefits you should know about-

How a TRC Can Help NRIs And Business Owners Save On Taxes

A TRC helps NRIs and business owners save on taxes by providing them with the necessary evidence to claim tax benefits under the Double Taxation Avoidance Agreement (DTAA) between India and the country where they are residents. This means that they do not have to pay taxes twice on the same income, which can result in significant savings.

TRC's Significance In Foreign Remittance And Investment

TRC is also significant in foreign remittance and investment. It serves as proof of the tax residency status of an NRI or a business owner and can be used to avoid withholding tax on foreign remittances and investment income. This can help save a considerable amount of money in taxes.

TRC's Role In Avoiding Double Taxation

TRC also plays a crucial role in avoiding double taxation. It serves as proof that an NRI or a business owner is a tax resident of a particular country and can be used to avoid paying tax on the same income in both India and the country of residence.

Benefits Of Obtaining TRC Through NoBroker

NoBroker offers hassle-free and convenient TRC application services to NRIs and business owners. By obtaining a TRC through NoBroker, you can enjoy several benefits, such as:

- Expert guidance throughout the application process

- Faster processing and delivery of the TRC

- Competitive Pricing

- Easy access to customer support

Consult with NoBroker's Tax Experts

At NoBroker, we offer expert guidance and assistance for tax-related services, including TRC and Form 10F application processes for NRI individuals from over 150 countries.

Expert guidance for TRC and Form 10F application process

Our tax experts provide step-by-step guidance throughout the TRC and Form 10F application process, ensuring that you have a hassle-free experience. They also provide advice on the eligibility criteria, documentation requirements, and common mistakes to avoid during the application process.

At NoBroker, we understand that tax-related services can be complex and time-consuming. Therefore, we offer a value proposition that includes:

- Expert guidance from qualified tax professionals

- Transparent and competitive pricing

- Easy access to customer support

Benefits of Consulting with NoBroker's Tax Experts

By consulting with our tax experts, you can enjoy several benefits, such as:

- Fast processing and delivery of the TRC and Form 10F

- Reduced chances of errors or mistakes during the application process

- Access to a team of qualified tax professionals with years of experience

- Competitive Pricing

How Can NoBroker Help?

Obtaining a Tax Residency Certificate and filing Form 10F is crucial for NRIs and business owners to save on taxes, avoid double taxation, and invest in foreign remittances. NoBroker's tax experts provide guidance for the application process, ensuring that customers avoid common mistakes and receive expert advice. While applying for a TRC or filing Form 10F, common issues like lack of knowledge, documents, and errors can be encountered.

NoBroker's services can eliminate these pain points. For those looking for TRC certificates in Bangalore and other parts of the country. NoBroker provides step-by-step guidance and assistance in obtaining important documents.

Overall, NoBroker's tax-related services are invaluable for those seeking to navigate the complex tax process with ease. Visit NoBroker NRI services for a consultation today.