Table of Contents

Loved what you read? Share it with others!

Tenant Police Verification in Pune - Ensuring Rental Security

Table of Contents

Pune is the bustling city of corporate opportunities and academic excellence. As the city is thriving, the demand for safe and affordable housing is also going up. This is where Tenant Police Verification in Pune emerges as a crucial safeguard. In this urban landscape, where students and professionals seek rental abodes, landlords rely on Tenant Police Verification in Pune to ensure safe living spaces.

What Exactly is the Tenant Police Verification?

Under the Indian Penal Code (IPC) and its Section 188, all landlords must undertake police verification for renting out their properties. This covers order violations as declared by any public servant, convicts are punishable with simple imprisonment for a tenor which may go up to one month or a monetary fine of Rs. 200. If something goes wrong with the tenant or any illegal activity takes place, the landowner will be the one facing the repercussions. Hence, tenant police verification is one of the most crucial steps in the renting process.

Why is Tenant Police Verification Important?

Here are some significant reasons to carry out online police verification for tenant in Pune:

Heightened Security: Verifying tenants through police checks enables property owners to delve into the tenant's history, revealing potential criminal records. This vital data assists landlords in making informed decisions about who they permit to occupy their property, ensuring the community's safety.

Promotion of Responsible Tenancy: Following police verification, tenants often demonstrate responsible behaviour towards the property and community. The awareness that their records are with the police serves as an incentive for law-abiding behaviour and deters any non-compliance carrying serious legal consequences.

Validation of Nationality: As an integral part of the tenant verification process, police authorities scrutinize the tenant's prior addresses. This step aids property owners in verifying the tenant's Indian origin or nationality status, essential for compliance with legal requirements or building-specific regulations.

Documents Required For Tenant Police Verification

The documents required for tenant police verification in Bengaluru can vary slightly depending on the city or state, but here's a general list:

- Completed Tenant Verification Application Form: This can usually be downloaded from the local police department's website or obtained from the police station itself.

- Payment Receipt (if applicable): Some cities/states might require a fee for police verification. You may need to pay this fee at a designated centre and keep the receipt for your records.

- Copy of the Signed Rental Agreement: This is to prove your tenancy at the property.

- Photocopies of ID Proof (for Tenant and Landlord): This can include documents like Aadhar Card, Voter ID, Driving Licence, or Passport. Make sure to carry the originals for verification purposes as well.

Pune Police Verification Process for Tenant

There are two ways to get this done:

- Offline process

- Online process

Offline Process: Step-By-Step Guide

For those who opt for a traditional police verification form for tenants in Pune, landlords can proceed with the following steps:

- Step 1 - Acquire the Offline Verification Form: Acquire the tenant verification form offline, either from the nearby police station or by downloading it through the official website.

- Step 2 - Form Completion: Fill out the form with comprehensive details regarding both the landlord and the tenant. Attach their identification proofs, address proofs, and recent passport-size photographs.

- Step 3 - Submission at Local Police Station: Upon confirming the accuracy of the provided information, endorse the relevant sections of the form and deliver it to the local police station. The verification process will be supervised by the overseeing sub-inspector.

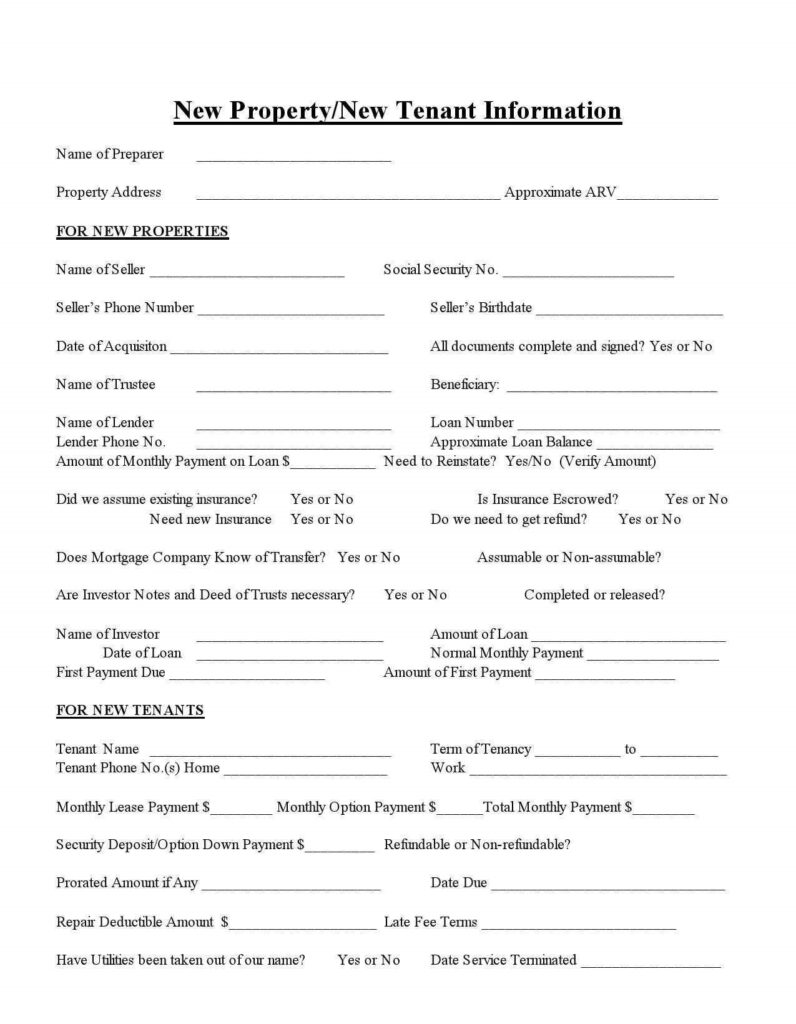

Tenant Information Form

Online Process: Step-By-Step Guide

Theonline application for police verification (Pune) is an extremely popular, quick, and convenient method that not only helps the citizens but also the government. Needless to say, the introduction of the online process has led to a sudden rise in the number of documents being registered in the city.

Getting an online police clearance certificate in Pune is simple. The landlords can easily fill up and submit the tenant police verification form online and get the police verification online Pune for rent. However, the landlords might have to visit the police station for verification if required. In fact, in Pune, online police verification of tenant’s information by the landowners is an important step after receiving the Leave and License agreement is registered.

Here's a detailed guide on how to carry out online tenant police verification in Pune:

- Step1: Start by visiting the Maharashtra Police Clearance Services official website.

- Step2: Register by locating the option in the 'Login' section, either by creating a new user ID or using existing login credentials.

- Step3: Select the desired service under the "Services" tab and

- Step4: Input your address details, moving to the next step.

- Step5: Continue the process by providing occupation and education information on the subsequent page.

- Step6: Enter general information as required and proceed to enter details about your local police station.

- Step7: Save your progress, receiving an application ID.

- Step8: Upload a passport-sized photo and digital signature as instructed.

- Step9: Upload the documents needed and review all information for accuracy.

- Step10: Click 'Submit' at the bottom of the page.

- Step11: Complete the payment using your preferred method, and upon successful payment, a receipt will be generated.

- Step12: The local police station conducts the verification process, and if necessary, the tenant might need to visit for additional checks.

- Step13: After the verification, download the Police Clearance Certificate (PCC) from the website.

Online Police Verification Pune Charges

The charges for online police verification in Pune are nominal. Landlords typically initiate the process, and they are charged a fee of ₹500 by the Maharashtra Police for tenant verification. You can find this information on various real estate websites or the Maharashtra Police website itself. Check the official Maharashtra Police website (https://pcs.mahaonline.gov.in/) for the latest updates on online police verification and any associated fees.

Pune Police Clearance Certificate (PCC): Police Verification in Pune for Tenants Online

The government has issued the Tenant Police Verification clause for public safety. An FIR could be lodged against a landowner for renting out a property to a Tenant without Tenant Police Verification in Pune. Hence, it is strongly recommended to get the details of your tenant registered with the police before trusting them with your apartment and get Pune Police Clearance Certificate. Save yourself some trouble and find trustworthy tenants with extremely reliable sources on Nobroker.in.

Click here for more information about Pune Police and other general inquiries.

Your home is your safe space. Renting it out to someone involves trust. Hence, it’s extremely important to carry out Tenant Police Verification to ensure the safety and security of your residential space.

Frequently Asked Questions

Ans: The Property owner can visit the nearby police station and ask for tenant verification forms. In some metropolitan cities, they can also perform the task through mobile apps. This can be done online too.

Ans: Police verification of the tenants is an important part of the tenant screening process that must be properly understood for your safety. According to the Indian government, the landlords must undergo police verification of their potential tenants. Any kind of negligence may invite a monetary penalty or even a jail sentence.

Ans: A rental verification form is a document of permission by the government that a tenant applicant needs to sign to permit the landlord to do a background check.

Ans: Here is your ste[-by-step guide for the online tenant police verification in Pune.

Fill the form with both tenant and landlord details

Affix the current photo of the potential tenant

Finish it with a sign at the bottom of the form. This is to confirm that the information mentioned in the form is authentic and you are agreeing to it

Submit the completed form for the police verification for tenant in Pune at the nearest police station

Make sure to collect the receipt of an acknowledgement for future reference

Recommended Reading

FSI In Pune 2025: Calculate FSI In Pune Municipal Corporation

January 31, 2025

67156+ views

Stamp Duty and Registration Charges in Pune: Rate Calculator and Key Factors in 2026

January 31, 2025

53131+ views

Noida Tenant Police Verification Procedure: Step-by-Step Guide

January 31, 2025

41903+ views

A Perfect Guide to Police Verification in Mumbai

January 31, 2025

41134+ views

Tenant Police Verification Process in India: Application, Downloads and Status Check in 2026

January 31, 2025

40983+ views

Most Viewed Articles

Franking Charges Explained: Meaning and Benefits

January 31, 2025

1116907+ views

Society Maintenance Charges : Meaning, Cost, Types and Calculation

January 31, 2025

201195+ views

Daughter's Right in Fathers' Property - the Law is Finally Equal for both Genders?

June 1, 2025

145761+ views

BBMP E-Khata Registration process for property owners in Bangalore, Karnataka in 2025

March 19, 2025

145603+ views

Rectification Deed Format and Process in India 2026

June 1, 2025

136121+ views

Loved what you read? Share it with others!

Recent blogs in

Article 35 I Lease Rent Deed: Process, Calculation and Legal Guidelines in 2026

March 9, 2026 by Kiran K S

Deed of Variation Lease: Meaning, Format & Legal Process Explained in 2026

March 9, 2026 by Manasvi Bachhav

Full RM + FRM support

Full RM + FRM support

Join the conversation!