Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

Submit the Form to Unlock the Best Deals Today

Help us assist you better

Check Your Eligibility Instantly

Experience The NoBrokerHood Difference!

Set up a demo for the entire community

4 significant trends emerging amid Covid-19 in Commercial Real Estate

Table of Contents

June 1, 2020: Scenario for the Indian commercial real estate looked promising in 2019, with a fresh supply of over 50 million sq. ft. and a net absorption that hovered north of 45 million sq. ft – primarily driven by IT/ ITeS, BFSI, consulting & co-working spaces. Total vacancy in the upcoming markets such as Bangalore, Chennai & Pune, was in single digit, further highlighting the robustness of the Indian office real estate.

Despite visible cracks in the Indian economy, the corporate world was bullish on India’s long-term growth potential. An unbelievable amount of institutional money was poured into the office real estate.

The bullish run, however, did not last long. As economic activities got disrupted following a nationwide lockdown, the domino effect started to emerge in an otherwise buoyant office real estate. Due to uncertainty & paranoia, and realtors trying out the digital way, aggregate sales & leasing activities have plunged.

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Only those projects will start shortly, which are in the last miles of completion (6 months -1 year) that can foresee light at the end of the tunnel.

It will take some time to arrest pandemics and the ensuing economic slowdown. Meanwhile, some new concepts will emerge which will entail a wider structural impact.

Rental Revisits

As most of the business activities have paused, organizations will ask for rental concessions or deferments with their landlords. This is a common denominator across the world. Likewise, in the next 2- 3 months, many businesses will ask for rental revisits. Generally, rents constitute 5-9% of the topline or revenues. There will be re-negotiation on rentals which might be inconclusive in many cases, thereby leading to exits. The industry might see a higher number of structured solutions for continuity and exits.

Refurbishments

New regulations are expected with respect to office space utilization, layout & safety standards. In the light of social distancing & a healthier working environment, mass recruiters will be mandated to allot larger space. Since the existing office spaces cannot be expanded, organizations will need to redesign & reconfigure their existing space to ensure hygiene and safety standards.

New Products in Market

As a repercussion of to rise in exits & decentralization, demand for quality yet affordable products will also rise. As a response to changing dynamics, investor activities will also steadily grow. The rise in investments will also be rooted in the fact that many investors are looking for risk mitigated assets that can offer good ROIs.

As market dynamics will evolve, so will be the developer’s offerings. Developers are expected to give additional benefits such as re-doing the floor plan.

The Weakening of Rupee & NRI Interest

NRIs will continue to deepen their foothold in commercial Indian real estate. In the past 12 months, the value of rupee has depreciated by more than 10%. Although this is not a very welcome sign for the economy, which is already marred with a widening fiscal deficit – this will be a shot in the arm for NRI buyers. Amidst global contingencies, many NRIs are looking for safer & smarter investment options. Commercial real estate with recurring rental income & smarter mid-term appreciation potential will fit into the requirements of the expatriate class. Affluent NRIs will even look out for portfolio investments.

Click below to find the perfect home for you with zero brokerage.

Loved what you read? Share it with others!

Most Viewed Articles

10 Best Places for Real Estate Investment in Pune in 2025

December 24, 2024

12988+ views

Indian Rental Market Trends 2025: Analysing Rental Market in India

December 7, 2023

12742+ views

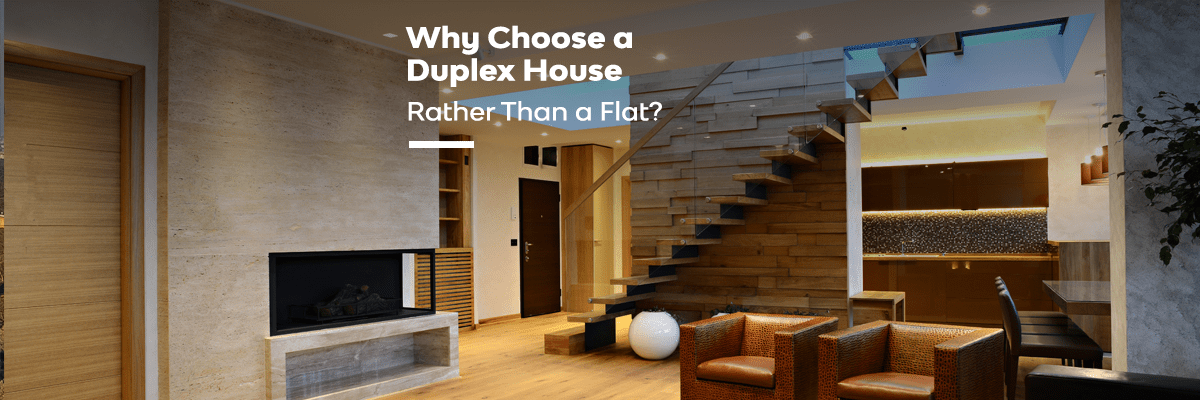

What is a Duplex House? Exploring Layouts and Benefits

August 24, 2023

6656+ views

RERA Bill 2016 Guide - Real Estate Regulation and Development Act 2016

December 1, 2016

5807+ views

Varun Dhawan House-The Stylish Bachelor Pad of India's Favourite Star

August 25, 2023

5777+ views

Recent blogs in

Best Places to Invest in Bangalore in 2025

January 7, 2025 by Vivek Mishra

10 Best Places for Real Estate Investment in Pune in 2025

December 24, 2024 by Vivek Mishra

How to Choose the Top 10 Cities in India 2025 to Invest in For NRIs

December 20, 2023 by NoBroker.com

Indian Rental Market Trends 2025: Analysing Rental Market in India

December 7, 2023 by Prakhar Sushant

Join the conversation!