Table of Contents

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

Loved what you read? Share it with others!

UPI for NRI Account: Sending and Receiving Money Made Easy

Table of Contents

Living abroad shouldn't mean managing your finances in India becomes a hassle. Enter UPI for NRI Accounts, a revolutionary payment system that empowers you to send and receive money conveniently and securely. Keep reading to learn how UPI can simplify your financial life as an NRI!

Can NRIs Use UPI?

Yes, NRIs (Non-Resident Indians) can use UPI for convenient money transfers! Here's a quick rundown of the eligibility criteria:

- NRE or NRO account with a KYC-compliant bank: You'll need to have a Non-Resident External (NRE) or Non-Resident Ordinary (NRO) account with a bank that adheres to KYC (Know Your Customer) regulations. This helps ensure the security and legitimacy of your account.

- International mobile numbers from specific countries: Currently, UPI access for NRIs is limited to international mobile numbers from select countries. These include Singapore, Australia, Canada, Hong Kong, Oman, Qatar, the USA, Saudi Arabia, the United Arab Emirates, and the United Kingdom.

Benefits of UPI for NRIs

Here are the benefits of UPI for NRIs:

Quality Service Guarantee Or Painting Free

Get a rental agreement with doorstep delivery

Find the BEST deals and get unbelievable DISCOUNTS directly from builders!

5-Star rated painters, premium paints and services at the BEST PRICES!

- Convenience: Gone are the days of waiting for bank transfers or relying on others. With UPI, you can send money to family, and friends, or for investments in India directly from your phone, all in real-time.

- Cost-effective: Unlike traditional money transfers, UPI transactions typically incur no additional fees. This allows you to maximise the amount of money that reaches your loved ones in India.

- Widely accepted: UPI integration is extensive in India. You can use it to pay for online shopping, recharge mobile phones, settle utility bills, and even make payments at stores with UPI acceptance through popular apps like PhonePe. This eliminates the need to carry cash or manage multiple debit/credit cards while visiting India.

- Manage finances remotely: Pay for family expenses or investments in India. UPI empowers you to take care of your financial commitments in India from anywhere in the world. You can easily pay rent, and tuition fees, or contribute to household expenses for your family back home. This ensures timely payments and provides peace of mind.

How NRIs Can Use UPI

Here's how NRIs can leverage UPI for their financial needs:

Requirements:

- NRI bank account linked to an international mobile number: Ensure your NRE or NRO account is linked to a valid mobile number from a supported country (refer to previous discussion for the list).

- UPI-enabled app: There are two options:

- Bank's UPI app: Many Indian banks offer their own UPI apps (e.g., SBI UPI). Check with your bank to see if they have a UPI app accessible for NRIs. SBI UPI is now available for NRI accounts with linked mobile numbers from ten countries, allowing them to make and receive payments in India.

- Third-party UPI app: Popular third-party UPI apps like PhonePe also cater to NRIs. Choose a reputable app that allows linking international mobile numbers. For instance, UPI transactions from NRO accounts to NRE accounts are not permitted.

Activation Process (General Steps):

- Download and install your chosen UPI app.

- Register using your NRI bank account details and international mobile number.

- Verify your mobile number using a one-time password (OTP) received via SMS.

- Set a secure UPI PIN for authorising transactions.

Important Considerations for NRIs Using UPI

While UPI offers a multitude of benefits for NRIs, there are a few key considerations to keep in mind:

- Transaction limits: NPCI (National Payments Corporation of India), the governing body of UPI, sets a general daily limit of ₹1 lakh (approximately $1,230 USD as of April 17, 2024) for NRIs. However, individual banks might impose lower limits on UPI transactions for NRIs. It's important to check with your bank for their specific limits. Additionally, there might be separate limits for specific transactions like bill payments or investments.

- Tax implications: While most routine UPI transactions within India generally don't incur any tax implications for NRIs, there might be tax liabilities for specific situations. For instance, receiving large cash withdrawals from UPI might be taxable. It's always recommended to consult a tax advisor familiar with NRI tax regulations for comprehensive guidance on potential tax implications of using UPI for specific transactions.

Popular UPI Apps for NRIs

Some popular UPI apps for NRIs are:

- PhonePe

- GooglePay

- BHIM UPI

Features to Consider When Choosing a UPI App

- Security measures: Look for robust security features like two-factor authentication (2FA) to safeguard your financial information.

- Wide range of billers and merchants for payments: The wider the network of supported billers and merchants, the more convenient it is to make payments for various needs.

- Customer support for NRIs: Reliable customer support that caters to NRIs is crucial for addressing any questions or concerns.

Note: It's also advisable to consult with a financial advisor specialising in NRI finances to make an informed decision based on your unique financial situation and goals or contact NoBroker for legal advice.

How Can NoBroker Help

UPI for NRI Accounts offers a revolutionary way for NRIs to manage their finances in India remotely. With its convenience, security, and cost-effectiveness, UPI empowers you to send and receive money, pay bills, and manage investments seamlessly. By considering the eligibility criteria, choosing a suitable UPI app, and understanding the important considerations, you can leverage UPI to simplify your financial life as an NRI.

Still confused about UPI for NRI accounts? NoBroker Pay is a digital wallet service that allows users to store funds and make payments online. NRIs can link their international debit or credit cards to NoBroker Pay to make payments for rent, maintenance charges, and other utilities. NoBroker Pay uses secure transactions to safeguard your financial information. Use NoBroker Pay for secure & easy rent payments. Download the app today!

Frequently Asked Questions

Ans: Yes, NRIs residing in specific countries can now use UPI for their NRE and NRO accounts. They can link their international mobile number from an approved country to their bank account and use a UPI app to make and receive payments within India. However, there are some restrictions on the types of transactions allowed.

Ans: No, currently only NRIs residing in specific countries can utilise UPI for their NRE or NRO accounts. These countries typically include Singapore, Australia, Canada, and the US. Check with your bank for the latest list of eligible countries.

Ans: Previously, an Indian mobile number was mandatory. Fortunately, you can now link your international mobile number from an approved country to your NRI account and use UPI with it.

Ans. NRIs can use UPI for various in-India transactions like sending money to family, paying bills, and making online purchases. However, some restrictions exist. Transactions from NRO accounts to NRE accounts might not be allowed.

Ans. The process can vary depending on your bank. Generally, you'll need a KYC-compliant NRE or NRO account, a UPI app (either your bank's or a popular option like PhonePe), and your international mobile number. Your bank's website or mobile app should have instructions for activating UPI.

Loved what you read? Share it with others!

Most Viewed Articles

NRI Power of Attorney for Property in India: How to Apply, Documents Required and Format

June 1, 2025

30549+ views

Know About ICICI NRI Account: Document Required, Eligibility and Application Process in 2026

January 31, 2025

27120+ views

NRI Accounts in India: List of Best NRE, NRO & FCNR Accounts in 2025

June 1, 2025

18060+ views

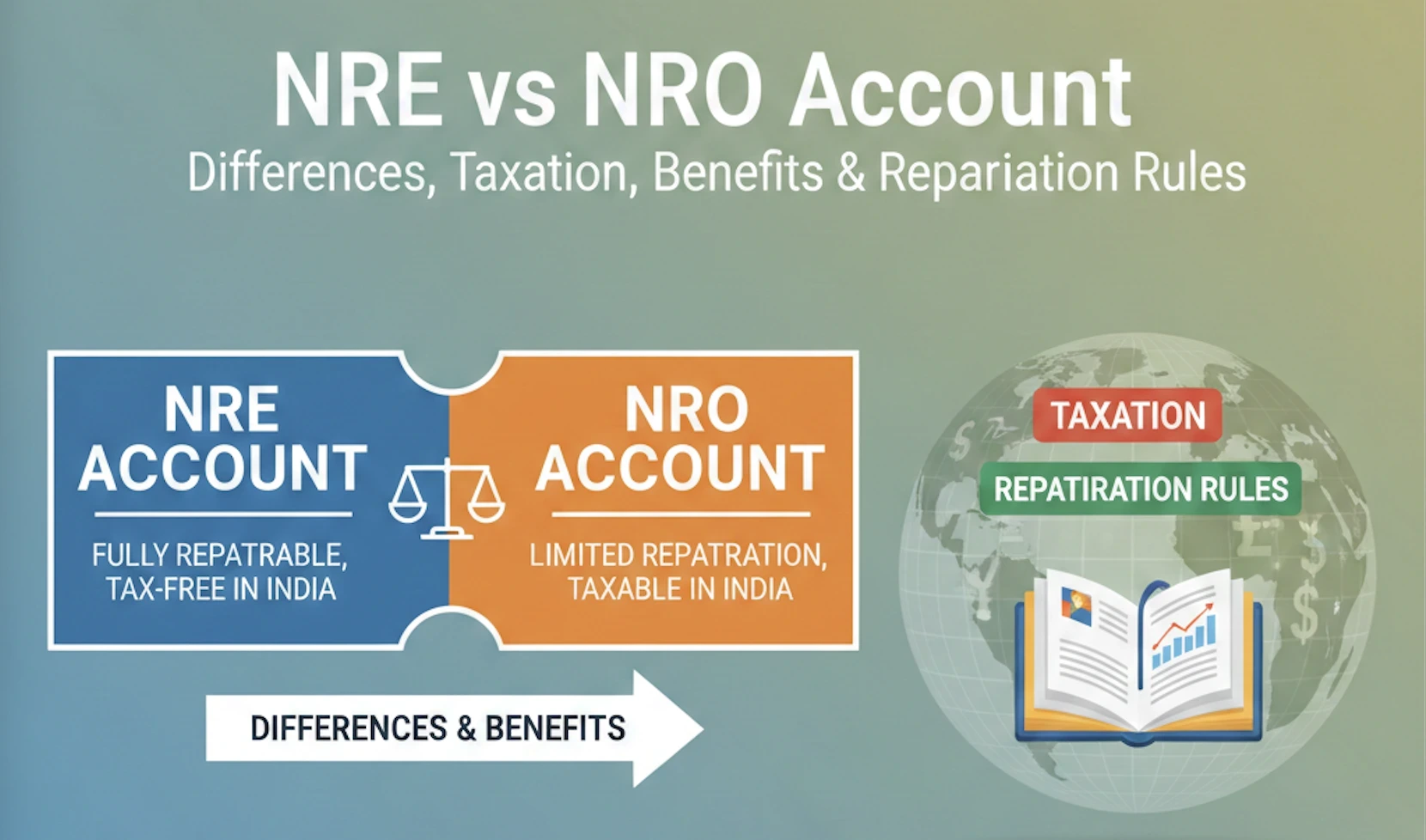

NRE vs NRO Account: Differences, Taxation, Benefits & Repatriation Rules

January 31, 2025

9940+ views

TDS on Sale of Property by NRI: Rules, Exemptions & Filing Process 2026

June 1, 2025

9065+ views

Recent blogs in

NRI Rights in India for Property: Ownership, Inheritance & Legal Rules for 2026

November 21, 2025 by Vivek Mishra

What is NRI Certificate: Meaning, Uses, Documents Required & Procedure in India

August 25, 2025 by Vivek Mishra

Power of Attorney from UAE to India: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

Power of Attorney for India Property from UK: Format, Documents & Legal Process in 2026

August 25, 2025 by Vivek Mishra

DTAA Between India And France: Tax Relief, TDS Rules & Benefits in 2026

August 22, 2025 by Kruthi

Full RM + FRM support

Full RM + FRM support

Join the conversation!