Filing taxes is a complicated process. I often get confused about the different types of taxes and the number of forms that need to be filled. A friend of mine recently shared with me details about form 12c income tax. In this answer I will share what I learned.

What is form 12c ?

What is form 12c ?

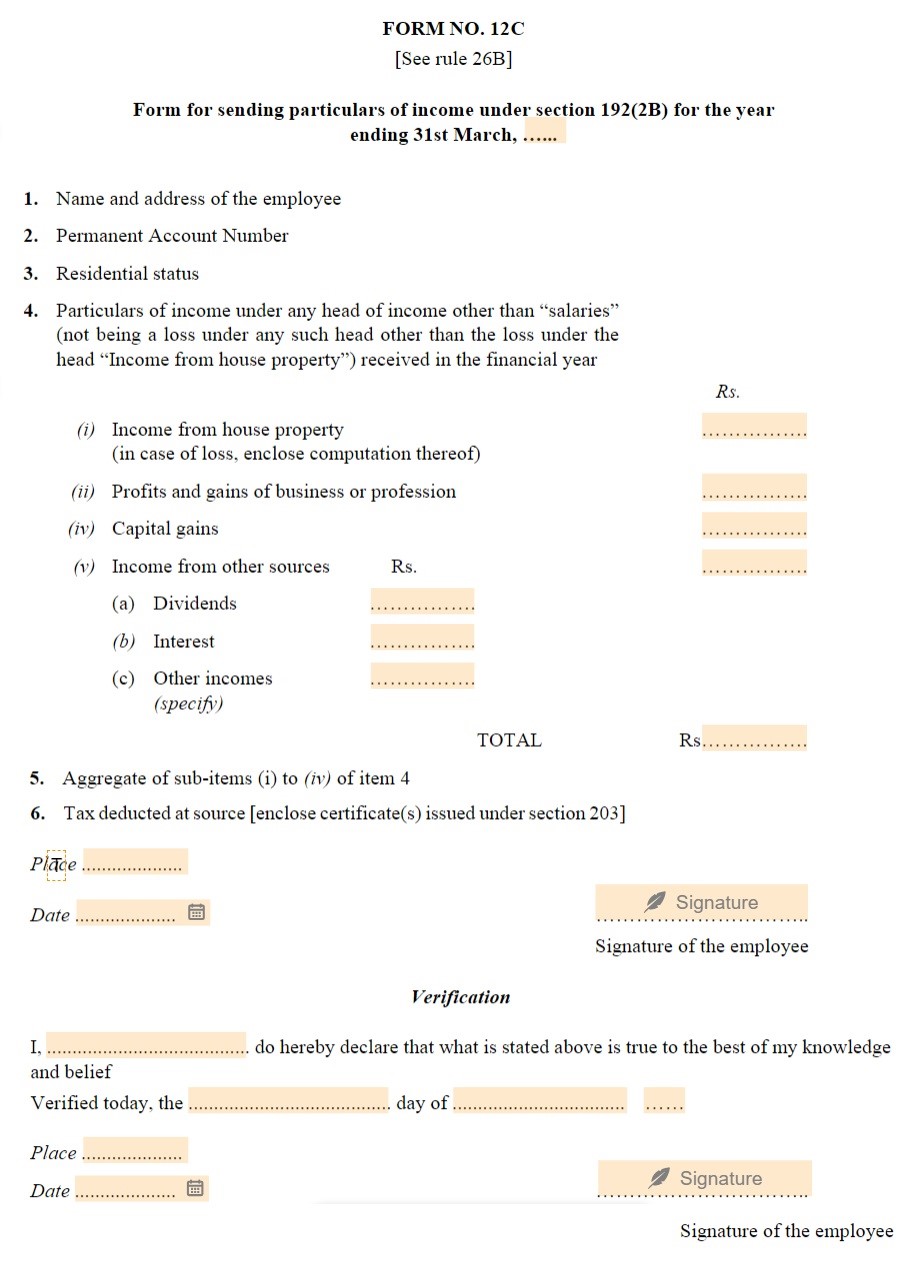

Form 12C was a document given by the Income Tax Department. Form 12C was the working sheet for income tax rebate for housing loans. Under Section 192 (2B), it was counted as income tax exemption).

How to fill form 12c income from house property?

The form has been discontinued by the Income Tax Department. Since form 12C is no longer operational

, you don't need to fill it or submit it to your employer.

On the other hand,

you can calculate the tax amount by visiting this portal by the Income Tax Department. This is only to give you an idea about the tax you will need to pay

Income from House Property

I hope now you know details about

form 12c income tax. Remember to pay your taxes on time and practice due diligence.

Read more :

How Property Tax is calculated in thane when property is given on leave and licence basis

What is let out property in income tax

How to save tax on home loan

Your Feedback Matters! How was this Answer?

Shifting, House?

✔

Lowest Price Quote✔

Safe Relocation✔

Professional Labour✔

Timely Pickup & Delivery

Intercity Shifting-Upto 25% Off

Check Prices

Intracity Shifting-Upto 25% Off

Check Prices

City Tempo-Upto 50% Off

Book Now

Related Questions

Filling out Form 12C for income from house property requires careful attention to detail and an understanding of the components involved in reporting your real estate income. Here is how to fill Form 12C income from house property.

Compile all essential documentation pertaining to the house property. This encompasses lease agreements, property tax receipts, and records of any expenditures associated with the property.

Enter personal particulars at the form's commencement, including full legal name, postal address, and Permanent Account Number (PAN).

Detail the house property, including its precise address, the property's nature (principal residence or leased), and the ownership structure (individual, partnership, etc.).

If the property is leased, specify the aggregate annual rental income received.

Include maintenance fees collected from lessees, as they contribute to the total income.

Calculate all applicable deductions in accordance with the Income Tax Act's provisions. Common deductions include:

Municipal taxes remitted during the fiscal year (deductible from rental income).

Standard deduction of 30% of the property's net annual value for maintenance and repairs.

Interest on any existing home loan, if applicable.

Subtract the total permissible deductions from the gross rental income to determine the net income derived from the house property.

Submitting the form to the relevant tax authority within the prescribed deadlines.

I hope you understand the steps for sample filled Form 12C income tax.

Get Help in Filing Form 12C from House Property by Certified Lawyers at NoBroker.Also check

How to Calculate GAV Income from House Property?Your Feedback Matters! How was this Answer?

A few weeks ago I was looking for the process of how to fill form 12C sample. Form 12C is provided by the Income Tax Department. It is a functioning document for the income tax credit for mortgage loans. Section 192 (2B) considers it as an income tax exemption.

It is a document that the worker gives to the employer explaining their additional revenue sources. When determining how much to withhold from wages for taxes, the employer may take into account any income sources other than salary if the employee completes form No. 12C with the relevant information.

How to fill form 12C for housing loan?

This document must be filled out and submitted by employees to their employers. The earnings of each employee from sources other than their salary must be disclosed. The form was previously available online at the main website of the Income Tax Department. This form has now been republished by the department.

Form 12C filled sample

Documents required for filling the Form 12C

Now that you know how to fill form 12C for housing loan, I must tell you the documents required for filling the Form 12C.

Property ownership information – It should go without saying that in order to claim this deduction, you must be the property owner. If you are a co-owner, figure out your percentage of the property. How much of a deduction you are allowed to take is based on how much of the property you own.

Construction’s completion or the date the property was purchased – The first year interest can be written off is the year the property's structure is complete. You can also claim pre-construction interest. You can deduct pre-construction interest over five equal instalments starting with the year you buy the house or the year the building is finished.

Information about the Borrower – The mortgage must be in your name, just like the title, in order to qualify for the deduction.

A certificate issued by the bank detailing your interest and principal.

Municipal taxes that have been paid throughout the year may be deducted from the revenue from a house's property.

Now you know how to fill form 12C sample.

Unlock your dream home with NoBroker's seamless loans. Legal confidence crafted by NoBroker's expert guidance. Read More: How to Fill Form 22 for EC? How to Fill Form 16 for Salary with Example? How to fill Form 26QB?Your Feedback Matters! How was this Answer?

There are multiple income tax forms available for different purposes. Some of them are still in use but some have been cancelled. One such is the Dorm 12C for home loan. It was a working paper for the income tax rebate that was used for mortgage loans. The Income Tax Department however stopped using it. I came across a form 12c filled example and that is when I started researching about it. It was considered a major income tax exemption under Section 192 (B) so it is good to have an idea about it. I learned a few more details about it so let me provide you with some more information here.

How to get form 12C?

Just like other Income Tax forms, Form 12C was available in its official portal which is-

https://www.incometax.gov.in/iec/foportal/

But now, you will find no trace of it there. If you are interested to see a sample filled form 12c income tax, you can check it out at the end of my answer. I downloaded it a long time back and have a pdf of it saved.

What is submission ID in form 12C?

A submission ID is a unique 20-digit confirmation number assigned by the IRS (Indian Revenue Service) or state when a person submits a tax return electronically. It is used to extract details whenever you contact the IRS/state about your return.

What is Form 12C declaration?

12C is a form that the employee submits to the employer, mentioning all sources of income but not the income from salary. This Form was supposed to be submitted by November 30 of the financial year.

What were the documents required for filling the Form 12C?

To fill out any form, you need a list of documents to be furnished. To fill Form 12C the documents required were-

Property ownership documents

Construction completion documents or documents stating the date when the property was purchased

All details of the borrower (name, occupation, address and more)

A bank statement certifying your interest and principal

Municipal taxes record that you were eligible for deduction from the house property income

You will find the form 12c filled example below.

Get your property-related legal queries resolved by NoBroker’s experts

Read More:What is Form 26AS in Income Tax?

How to fill form 12B?

Your Feedback Matters! How was this Answer?

A form called Form 12C was made available by the Income Tax Department for the income tax credit on mortgage loans. This document specifies the employee's additional revenue sources and is provided to the employer. You as an employer may subtract taxes from compensation based on any income sources other than salary. You can do it if you as an employee complete Form No 12C with the required details. So keep reading to know more about the 12C Form income tax.

Register the property with your name from the experts at NoBroker here after knowing about the 12C Form. Register the rent agreement in your name from NoBroker here which will help you with the 12C Form filling process.What things to consider before filling out Form 12C?

1) The loan needs to be in your name, exactly such as the title, in order for the deduction to be allowed. Co-borrowing the loan is a choice that is available to you.

2) You will need an official document from the bank that details your interest and principle.

3) Municipal taxes are allowable as a deduction from residential property income if they were paid during the year.

4) You need to be the owner of the property in order to claim this deduction. If you're a co-owner, figure out your ownership percentage. What kind of deduction you are qualified to take depends on your ownership interest in the property.

5) Interest can only be written off starting in the completed year of the property's construction. In fact, you could claim pre-construction interest.

I hope you understood the things to keep in mind about the 12C Form income tax.

Read More: How to fill Form 12B? What is Form 12B? How to fill out Form 60? How to fill Form 15G?Your Feedback Matters! How was this Answer?

Hey friend,

I see you have a question about the application process of form 12 c income tax. Even though your question is valid. I need to inform you that 12 c form has been taken out of circulation by the Income Tax Department. Out of curiosity, I asked my father what the purpose of the form was and when it was filled. I will share all the information I gathered in the paragraphs given below.

How to fill form 12c income tax ?This form was filled out by employees and submitted to the employers. All the employees had to disclose the income they received from sources other than their salary. Earlier on, the form was available online on the official website of The Income Tax Department. Now, the department has reissued this form. It is not available online or offline.

The income tax department released form 12c income tax purpose. You can read all the reasons below.

Equal treatment :

To make sure all the employees get fair, reasonable treatment. They were allowed to fill out the form and submit the details.

Appeal :

Because of the form, a taxpayer could file an appeal in case they felt they have been wronged. The form was a supportive mechanism for citizens of the country.

Record :

By getting the form filled the department was essentially recording accurate information. By law, the income tax department is required to fulfil its compliance obligations.

Tax :

The 12 c form allowed the department to collect the correct amount of tax from people. It also allowed people to pay the correct amount of tax to the department.

Privacy :

My dad also told me that under the due process of law, filling out the form allowed taxpayers to have proper privacy for the inquiry, examination, or enforcement process.

This is all from my end on form 12 c income tax. Leave a comment below and let me know if you agree with my answer or not.

Looking to rent the property of your dreams Explore NoBroker's

Tenant plans to get genuine leads.

Pay your utility bills online and get assured rewards like cashback. Check out NoBroker Bill Payment Service today.

Read more :

How to fill form 12B?

What is form 12B?

Your Feedback Matters! How was this Answer?

Leave an answer

You must login or register to add a new answer .

How to fill form 12C income from house property ?

Sneha

19643 Views

6

4 Year

2022-01-09T12:59:44+00:00 2023-08-01T18:55:50+00:00Comment

Share